What You Should Know Before Starting Your Investment Journey

In the ever-evolving world, nothing remains constant, just like the multitude of ways people choose to earn an income. Some believe in building a small business enterprise and fighting for survival in the market.

At the same time, some prefer holding a safe position in a multinational company as their constant source of income. And then there are people, who found a different way to utilize their intellect and retain earnings and multiply their wealth by investing.

https://altrixconnect.org/, a website known for providing quality education in the field of investment to individuals wishing to start their journey. And what’s a better way to get started than by connecting with an actual company to learn to invest?

Before that, let’s dive into the things to know before you actually begin your investment journey.

What Does It Mean to Invest?

Before entering the complex world of markets and investments, it’s essential to know what investing means. Investing is the allocation of resources, typically money, to generate income or profit out of it.

An investment is an asset or an item purchased with the expectation that it will increase in value at some point in the future, though this might not always be true.

When we talk about investment, the only thing that might come to your mind is investing in stocks and cryptocurrencies. But what we should know here is that investment is wider than just that. Whether you are using your money to build a firm, or purchasing a new real estate property or machinery with the purpose of reselling, it all counts as an investment.

With that, let’s go into detail about some of the major types of investment in the market that are known for their higher expectancy of ROI (Return on Investment).

The Various Types of Investment

Till now, you would already have a pretty good idea of the term investing. The world of investment is vast, with a multitude of investments to make. Having multiple options to choose from is never a bad thing, right?

Stocks

One of the most popular investments is investing in the stocks of a company. Most of the top tier companies, if not all, always issue new shares of their company in the stock market once in a while. These shares can be bought by investors or brokers, making them one of the shareholders of the company.

In this case, it is important to know that not every share is of the same type and will provide the same return. Two of the most common shares issued by a company are Equity and Preference shares. Equity shareholders have the right to vote in the company’s board meeting but do not have a guarantee for the repayment of their money at the time of liquidation of the firm.

Whereas preference shareholders are the ones with a fixed rate of dividend they do not have any right to interfere in the firm’s decision-making. These shareholders are always the first ones to be paid whether the company gets profit or loss.

Bonds and Debentures

Another investment related to an enterprise is buying bonds and debentures. Bonds are debt instruments issued by financial institutions, large corporations, and government agencies to receive funds from the public. These bonds are always backed with collaterals, such as shares or physical assets, in case the firm is not able to repay the amount within a period.

Debentures are similar to bonds, but in this case, they’re issued by private companies as a way to collect funds for their business. These debt obligations are not backed by any collateral or assets, which makes them a riskier choice.

Funds

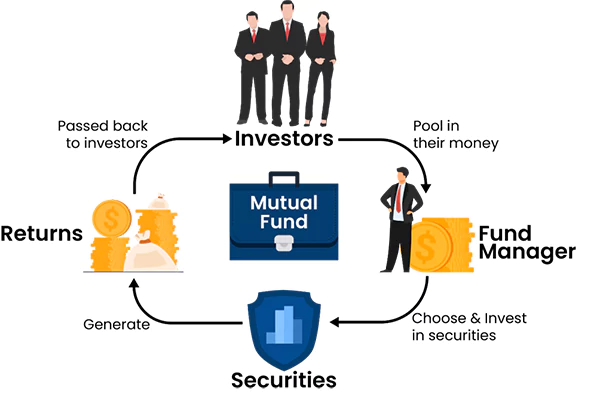

Instead of investing in individual companies, investing in ETF, index funds, and mutual funds often proves to be a better choice. For instance, an investor may purchase shares of an individual mutual fund that owns shares of emerging market companies with short capital rather than spending days researching individual companies to invest in.

The difference between a mutual fund and an index fund is that mutual funds invest in a changing list of securities that are chosen by an investment manager. Whereas index funds invest in a specific list of companies (such as stocks of S&P 500-listed companies). Index funds are known to deliver reliable long-term profits, while mutual funds have the potential to provide higher rates of returns.

Cryptocurrency

Cryptocurrency trading has become increasingly popular in recent years, and many people view it as an investment opportunity. While Bitcoin is probably the most well-known digital currency, there are thousands of other cryptocurrencies already out there. You can buy cryptocurrency directly, or you can invest in crypto funds or companies.

Investing in cryptocurrencies is known to be quite riskier. The price rate of digital currencies, even the most well-known ones like Bitcoin, can be a lot more dynamic than stocks. Thus, it takes expertise to actually earn profits by investing in crypto.

Key Takeaways

Investing is done in the hopes of getting more money in the long run. From stocks and bonds to funds and cryptocurrencies, the digital age has brought a multitude of options to invest your money the right way.

Remember that it may not always result in high profits, and you might end up acquiring a major loss at times. Thus, it is important to take the necessary steps before investing in a particular entity.

Regardless of how you invest or even what you invest in, it’s essential to research the entity, your investment manager, or your investment platform before taking any action. And while you’re on your way, allow Altrix Connect to guide you on your path to successful investments.

Follow Us

Latest Post